child tax credit december 2021 how much

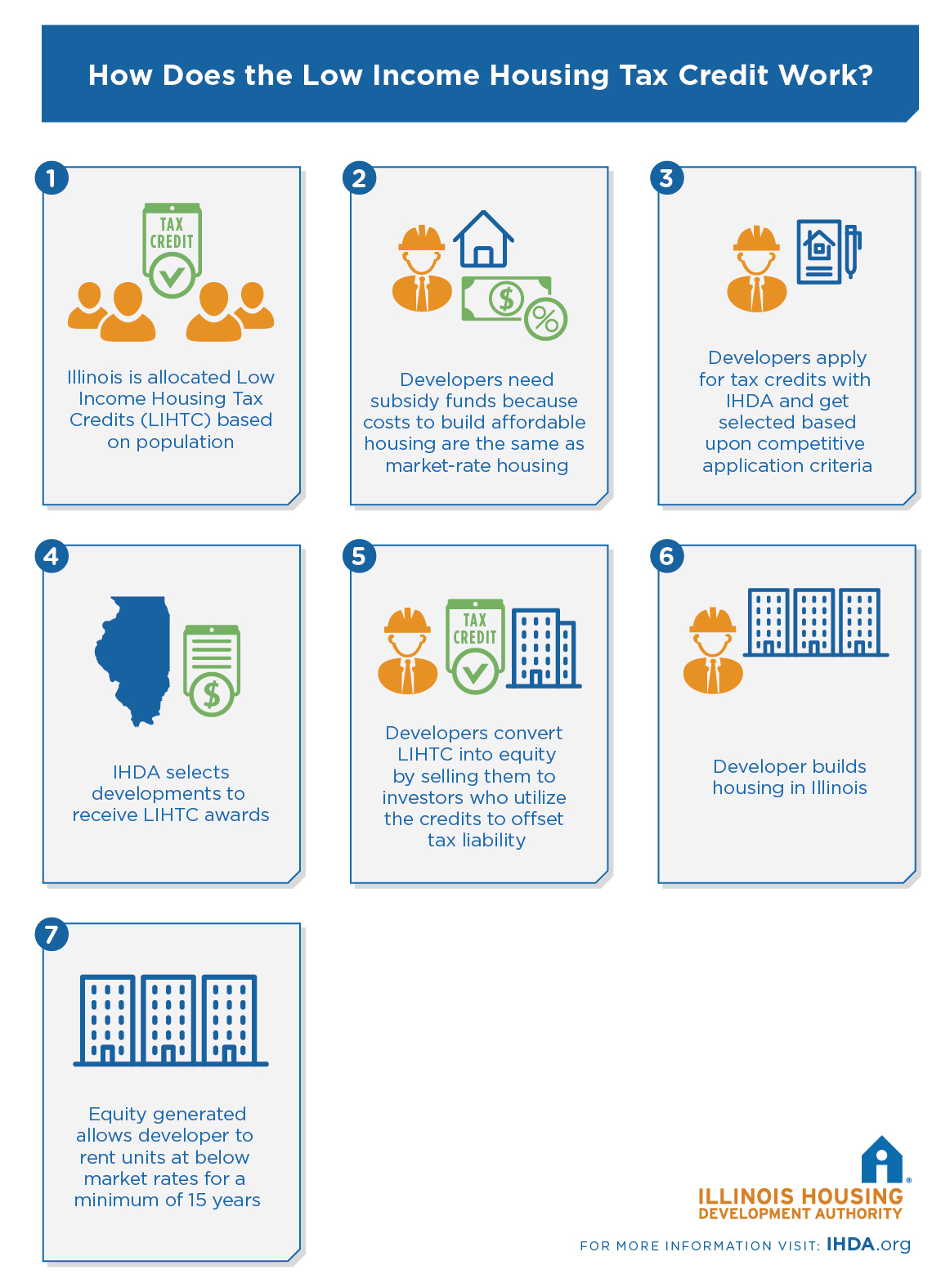

The 19 trillion American Rescue Plan Act of 2021 which was signed into law by President Joe Biden in March increased the maximum child tax credit for 2021 to 3000 for children ages 6 to 17 and to 3600 for children under 6. The income limits for qualifying for the full tax credit are a little lower in 2021 than they were in 2020.

Child Tax Credit 2021 8 Things You Need To Know District Capital

For each qualifying child age 5 or younger an eligible individual generally received 300 each month.

. The 2021 tax season kicks off on Monday which has many wondering how much money they can expect to collect. When you file your 2021 taxes you can expect to receive up to 1800 for each child aged five and under. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

Ad File a free federal return now to claim your child tax credit. Lets say you qualified for the full 3600 child tax credit in 2021. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6.

How much is the 2021 child tax credit. Now lets see whats going to happen for the 2021 tax year. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Families will receive the other half when they submit their 2021 tax return next season. For parents with kids between the ages of six and 17 you can expect to receive up to 1500 for each child. While you can get 3600 for every child under the age of six.

Thats a pretty nice big perk of a. Its 3600 for children under 6 and 3000 for. The IRS says that eligible families who didnt get any CTC payments can claim the full amount on their 2021 federal tax return.

You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return. Those under the age of 18 are included. This amount was then divided into monthly advance payments.

An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit. Among other changes the CTC was increased this year from 2000 per child to as much as 3600 per child as well as extended for the. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

The expanded credit benefits roughly 9 in 10 children across the country. April 2022 or whenever taxes are filed. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older.

2021 Child Tax Credit. The new advance Child Tax Credit is based on your previously filed tax return. Visualize trends in state federal minimum wage unemployment household earnings more.

That would mean they can claim the full credit when they file their 2021 taxes. The Child Tax Credit provides money to support American families. In December these families will receive a lump-sum payment of 1800 for younger children under six and 1500 for those between six and seventeen.

There has been no set start. Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit. Like the previous child tax credit the 2021 Child Tax Credit restricts who will qualify for the credit based on adjusted gross income.

ADVERTISEMENT Theres no limit on eligibility based on the number of kids who qualify as dependents. If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to. Ad Explore detailed reporting on the Economy in America from USAFacts.

The 500 nonrefundable Credit for Other Dependents amount has not changed. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week. A married couple with three children who have 56844 in adjusted gross income could get the full benefit.

Its beneficial for lower- and middle-income earners. 3000 for children ages 6 through 17 at the end of 2021. The maximum credit you can claim is 6660 for the 2021 tax year.

However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. For tax year 2021 the Child Tax Credit is. However there are a lot of variations involved.

Here is some important information to understand about this years Child Tax Credit. To help taxpayers support their families the American Rescue Plan greatly expanded the child tax credit in 2021 so that taxpayers can now receive 3600 for every dependent child under the age of six and 3000 for every dependent child over the age of six. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child. According to the IRS.

These payments may be made in advance and reflect a portion of the tax year 2021 Child Tax Credit rather than receiving this credit as part of your return in 2022. 3600 per child younger than age 6 and 3000 per child between ages 6 and 17. 3600 for children ages 5 and under at the end of 2021.

According to the American Rescue Plan and an IRS Fact Sheet about the law heres how the 2021 child tax credit will work. However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child. Eligible families may get a 300 monthly advance payment of their 2021 Child Tax Credit for each child under the age of six and a 250 monthly advance payment for each child aged six and older.

The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. The next child tax credit check goes out Monday November 15.

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

2021 Child Tax Credit Advanced Payment Option Tas

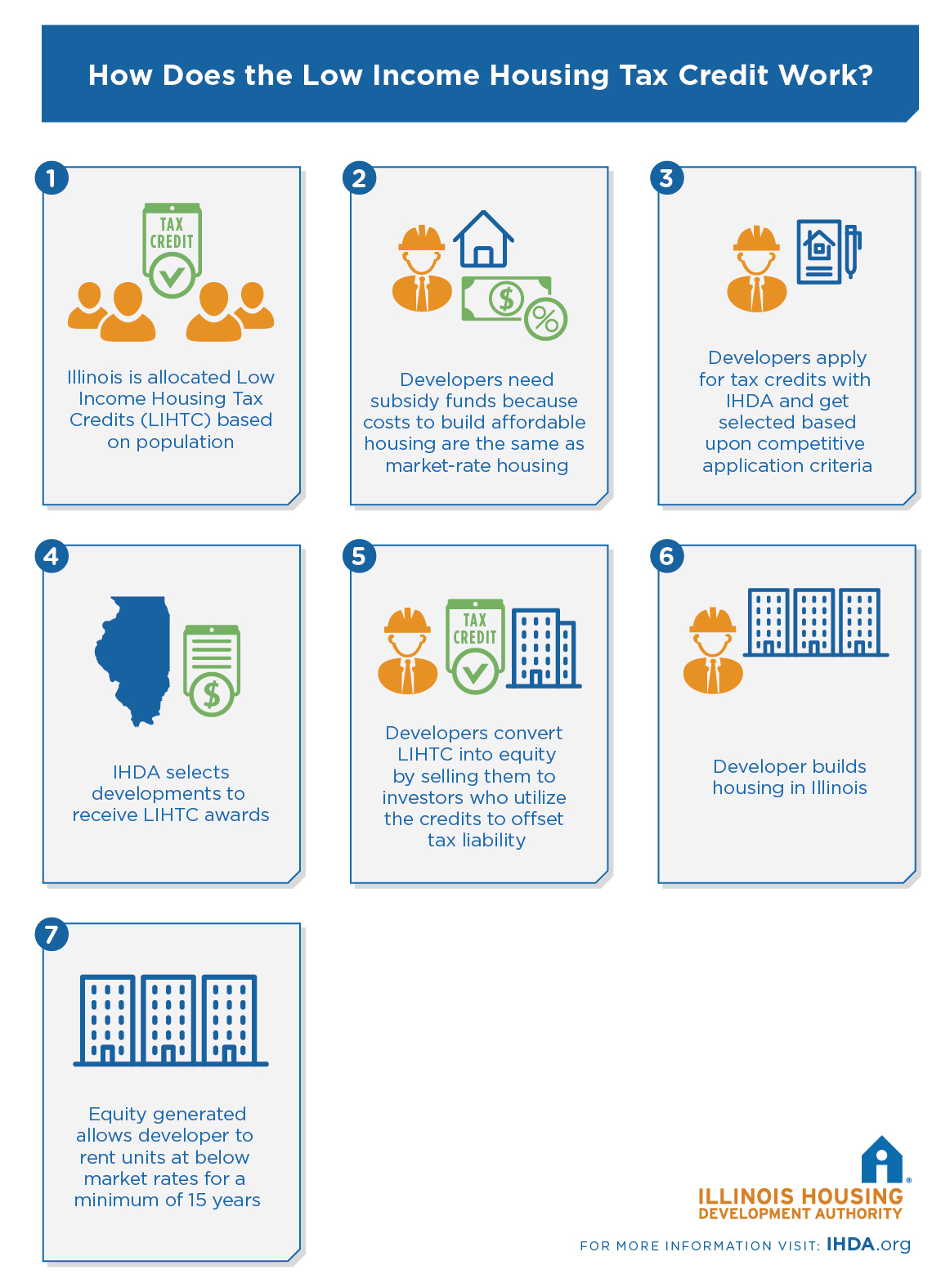

Low Income Housing Tax Credit Ihda

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

What Families Need To Know About The Ctc In 2022 Clasp

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Definition Taxedu Tax Foundation

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 Update Millions Of Americans Can Claim 2 000 Per Child Find Out Your Maximum Amount

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2021 8 Things You Need To Know District Capital